A fiscal pattern is used to define date formats and calculations in relation to your how your organization has defined its fiscal calendar. Fiscal patterns divide fiscal years into periods (usually quarters), and then define the number of weeks for each of the three months that fall within. All fiscal patterns rely on a fixed calendar date from which all past and future dates and calculations are based. However, a fiscal pattern's start date and a fiscal calendar's start date do not need to be identical. Fiscal patterns generally do not account for one or two days per year (depending on leap years); an additional week is periodically added to the final month (typically January) to account for the extra days.

The format for defining a fiscal pattern is a comma delimited row of 12 digits (or 13, if your organization's fiscal calendar has 13 periods). Commas separate each quarter in the fiscal year. Rows separate each fiscal year. Each digit in a row represents the number of weeks in a month for the position of the month in the fiscal pattern. The number of weeks in a month used in the fiscal pattern should match the number of weeks that have already been defined for each month in your organization's fiscal calendar.

- 445, 445, 445, 445 This method is the default fiscal pattern and follows the most common breakdown: years are broken into quarters, quarters into thirteen weeks (two four-week months followed by a single five-week month), all anchored to a specific date in the fiscal calendar.

- 454, 454, 454, 454 This method is common in retail accounting and it helps to maintain consistent patterns for weekends and holidays across reporting periods and months across reporting years. Every month within this fiscal pattern begins on a Sunday and ends on a Saturday. Every month across the pattern (year-to-year) is identical. A retail accounting fiscal pattern typically configures its calendar to begin on the first Sunday in February.

- 544, 544, 544, 544 This method is a variation on the 445 fiscal pattern. Each quarter is divided into thirteen weeks (a single five-week month followed by two four-week months).

- 4444, 444, 444, 444 This method uses thirteen fiscal periods instead of four fiscal quarters. Each period has four weeks; each week has seven days. One advantage of using this fiscal pattern is that every reporting period is identical. One disadvantage of using this fiscal pattern is that it does not contain fiscal quarters, which are a requirement for some types of financial reporting methods.

- A typical fiscal pattern:

445,445,445,445

- A fiscal pattern that includes 13 periods:

4444,444,444,444

- A multi-year fiscal pattern. In this example, the fiscal year is configured to begin on the first Saturday in February, repeats, and then catches the extra week in January during the fifth year:

445,445,445,445 445,445,445,445 445,445,445,445 445,445,445,445 445,445,445,446

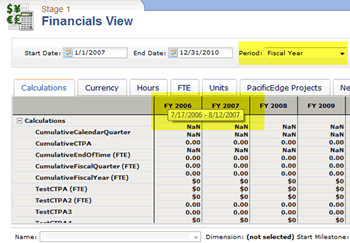

When a fiscal pattern is applied to your organization's fiscal calendar, users will be able to view the date range defined by the fiscal pattern in areas where fiscal dates are visible, such as in the Financials tab in the Projects module. Hovering over a date column in a grid will show the date range that is being used to define the fiscal year being shown. For example: